The international olive-oil sector and the special case of Portugal

Traditional olive groves in Portugal cover a total area of 133,270 ha (30.8 % of the country’s olive acreage), with the largest presence in the Beira Interior and Trás‑os‑Montes regions.

Modern cup‑shaped groves occupy 134,000 ha (31 %) and are distributed fairly evenly across all regions. High‑density groves span 69,300 ha (16 %) and are located in the same regions as hedgerow groves. Modern hedgerow groves account for 95,000 ha (22 %).

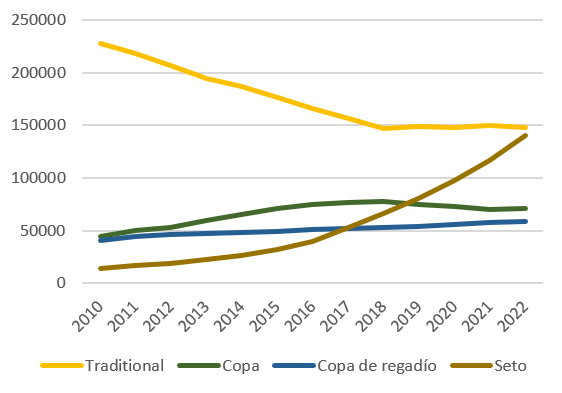

In 1999 only 2 % of all Portuguese olive groves were modern; today they represent 63 %. In just 20 years, Portugal has transformed its olive sector from traditional and less competitive to modern and efficient, reaping both direct and indirect benefits.

Evolution of olive area in Portugal

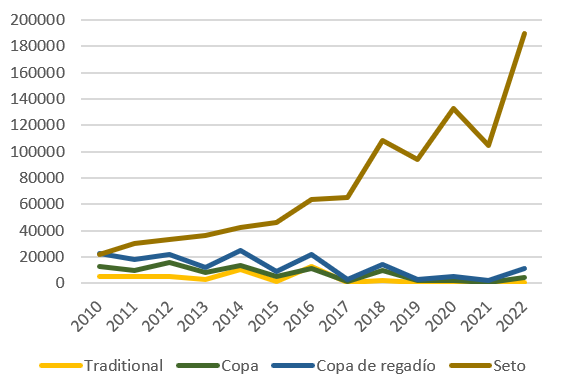

Evolution of Production in Portugal

The next figure (Figure 1) shows how Portugal’s olive acreage has evolved. Modern groves have expanded while traditional groves have been abandoned or converted. From the 2017/18 crop year onward there is a clear drop in cup‑shaped dry‑farmed acreage, underscoring Portugal’s commitment to maximizing efficiency. Portugal was the first country to convert modern cup‑shaped groves into modern hedgerow groves—a trend likely to spread worldwide.

In the last four crop years shown (through 2022, not including 2023) production has shifted decisively toward hedgerow groves, driven mainly by labor shortages and the superior competitiveness of this system.

Future Trends

If recent trends continue—ongoing gains in modern olive growing and ample resources in key producing zones—output should keep rising steadily and at a healthy pace, provided climate conditions remain broadly normal. Although abnormal weather could reoccur, any repetition is expected to be longer‑term, by which time agronomic resources are likely to have improved. A potential new climatic cycle would boost yields; combined with greater planted area and more efficient management, this could make Portugal the third‑largest olive‑oil producer in the world within five crop years.

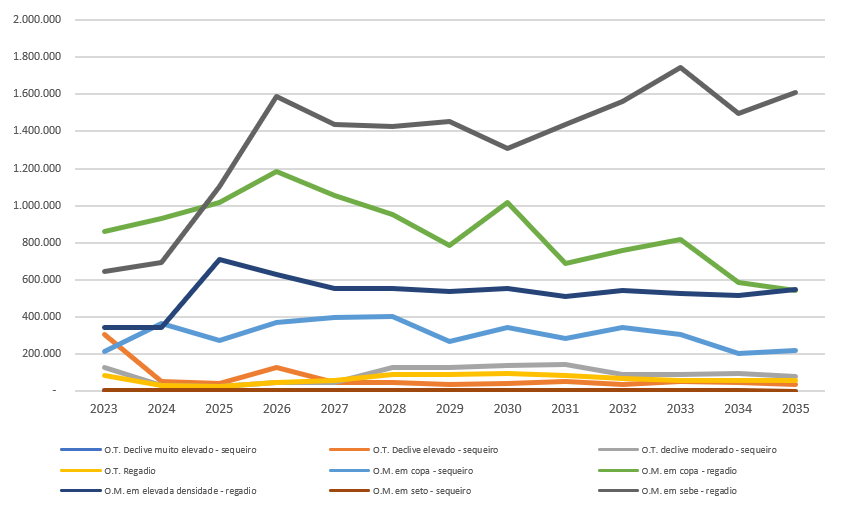

Using the parameters outlined above, we can project possible global olive‑oil production by cultivation system. The fastest‑growing systems worldwide are irrigated hedgerow and high‑density groves, which will deliver most future output. This is depicted in Figure 3.